Ledger’s Place in the Insurance Industry

Contents

Ledger’s Place in the Insurance Industry#

Insurance Basics#

At their core, insurance policies are risk transfer mechanisms. I don’t have enough in assets to pay off my mortgage if my house were to burn down, let alone to build a new house. I’d rather not run the risk of financial catastrophe if my house is destroyed by fire or other disaster. Therefore, I pay a (relatively) small amount of money each year for homeowners’ insurance, which will indemnify me (i.e., make me financially whole) in the unlikely event that my house is seriously damaged or destroyed.

This is a risk transfer mechanism because I swap the obligation to pay a very uncertain, potentially very large amount (repairing or replacing my house) for the obligation to pay a very certain, much more reasonable amount (my homeowners’ insurance premium).

The world of insurance can be roughly split into three sectors: life insurance, health insurance, and property & casualty (or P&C) insurance. Each of these types of insurance is a risk transfer mechanism, but the characteristics of the risks being transferred are so radically different that each sector of the industry functions more or less independently. The P&C sector of the industry handles insurance for physical assets (property) and legal liability (casualty).

Ledger’s Focus on Casualty Insurance#

At Ledger Investing, we primarily focus on securitization of casualty risk. There are a few practical reasons for this. The first reason is that there is already mature market already exists for institutional investors to buy and sell property risks. We don’t have any competitive advantages against the incumbents in that space, so we see no strategic reason to try to compete against them on their home turf.

The second reason is that the statistical models used to assess risk on property insurance portfolios are typically quite different from the models used in casualty insurance. In casualty insurance, we can typically assume that the specific causes of each individual claim are unrelated, and that the timing of claims are uncorrelated with each other. This allows us to make important simplifying assumptions when building statistical models of portfolio-level risk. By contrast, the vast majority of losses on homeowners’ insurance and commercial property insurance are for major natural disasters like hurricanes, earthquakes, and wildfires. A single hurricane that can cause billions of dollars of property damage in 48 hours or less is the quintessential example of a correlated risk, and quantifying that correlation is extremely important. For that reason, modeling property insurance risk on the East Coast of the United States quickly turns into an exercise in modeling hurricanes. Models of property insurance risks in other areas are often effectively models of the predominant natural disasters in those regions.

Finally, the financial characteristics of casualty insurance are significantly different from property insurance. In property insurance, determining whether the insurer is responsible for paying a claim is straightforward, and determining the amount of money the insurer must pay to repair or replace the damaged property is a relatively quick process. On the other hand, it can years of litigation to determine whether an insurer must pay anything at all on a directors and officers’ liability claim, and the amount that must be paid is highly uncertain as well. In workers’ compensation, it may be decades until the final costs associated with an individual claim are known with certainty. This long delay before claims are paid out and high degree of uncertainty while claims are pending means that casualty ILS transactions must be structured quite differently from property ILS in order to ensure that the insurer is actually transferring a meaningful amount of risk to the investor, and that investor is able to obtain an adequate return on their investment.

Lines of Business and Programs#

Lines of Business#

Even within the P&C sector, there is quite a bit of risk heterogeneity. Auto insurance, workers’ compensation insurance, medical malpractice insurance, product liability insurance, homeowners’ insurance, and miscellaneous transportable property insurance (known for historical reasons as “inland marine” insurance) all fall within the umbrella of P&C insurance. The P&C sector is typically divided up into product lines, or lines of business. For example, workers’ compensation is a line of business, as is commercial auto and private passenger auto. Lines of business can be classified as property or casualty lines, although the distinction isn’t always perfectly clear-cut. For example, the vast majority of private auto insurance losses are from liability claims, so it is generally considered a casualty line, although some of the losses come from damage to cars, which is property.

Programs#

Lines of business divide the P&C sector into relatively coarse segments. There is considerable diversity even within lines of business. For example, commercial auto insurance includes long-haul truckers, taxis, delivery vans, ride share drivers, school buses, and medical transport vehicles. The risk originators we work with typically organize their insurance offerings into programs, which are typically products that are tightly targeted toward a specific market segment within a line of business. For example, one program may focus on commercial auto coverage for tow truck operators in the Deep South, while another may focus on workers’ compensation coverage for artisan contractors (such as plumbers and electricians) in the greater New York City region. Risk originators may run more than one program, each of which is managed independently. When we analyze the performance of a book of business, we typically do so at the program level, and our transactions typically consist of one or a few programs at a time.

Insurers and MGAs#

Up until now, we have referred to the company that issues an insurance policy as an insurer. This is technically accurate, but it masks some important distinctions we’ll address now.

What Makes an Insurer?#

Insurance markets are typically subject to a high degree of legal scrutiny. In order for a company to issue an insurance policy, it must be licensed as an insurer in that state, meet minimum capital and solvency requirements, and file additional information with the state regulator about the insurance policies it plans to issue. For these reasons, starting a new insurer requires a lot of money – say, $50 million or more.

All of these rules are designed with the consumer in mind – the state wishes to ensure that the insurer is charging rates that are adequate and not excessive or unfairly discriminatory, and that the insurer has enough capital on hand to pay all claims arising from policies that it writes, even if losses are significantly worse than predicted. A quick survey of insurance companies that have gone insolvent in the past shows that these rules do prevent consumers from real harms that the consumers are not equipped to avoid themselves. However, a side effect of this strict regulatory environment is that it is fairly difficult for new insurers to enter the market.

MGAs#

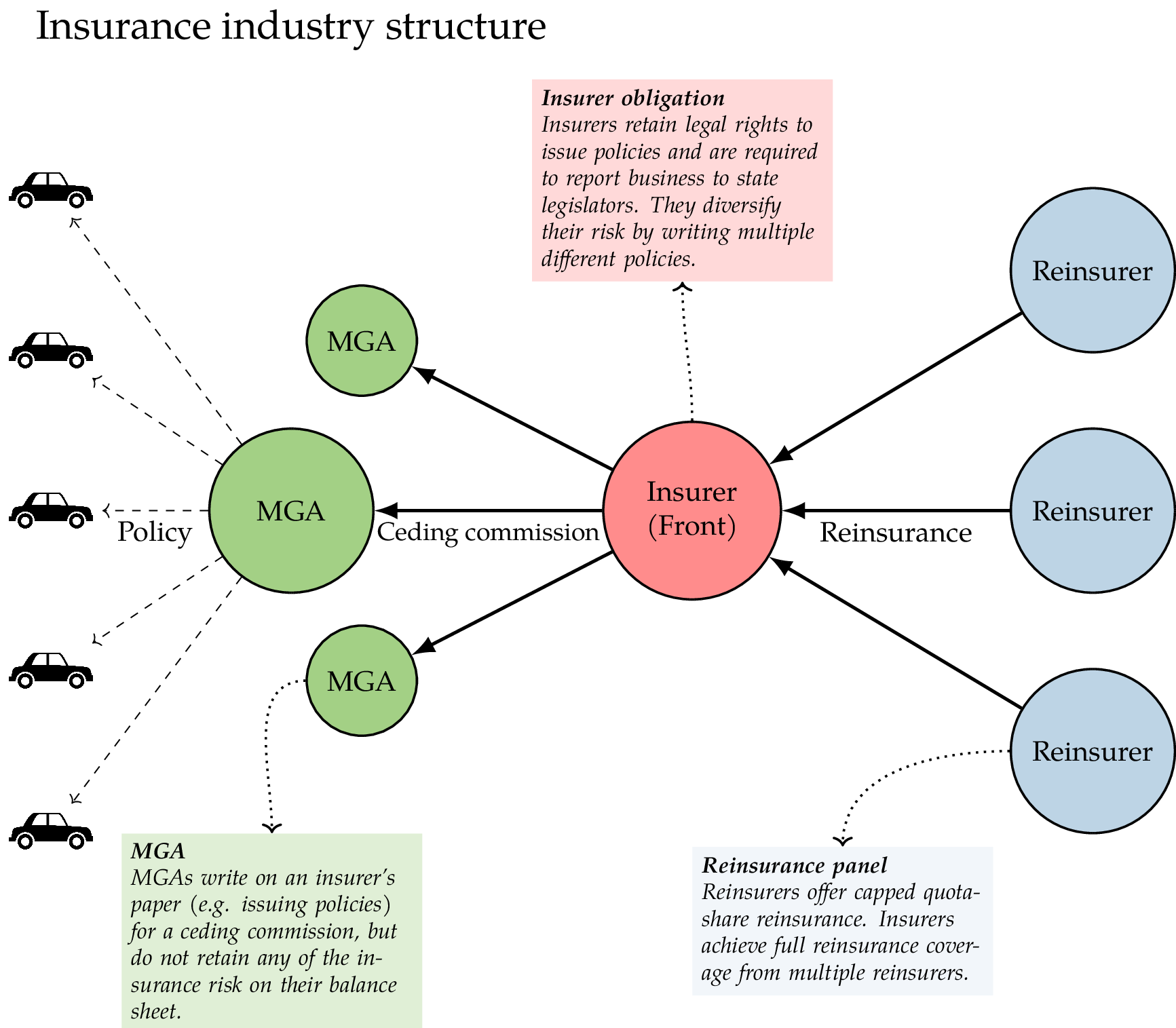

However, there is a regulatory loophole that allows for innovators to enter the insurance market with relatively low overhead: managing general agents, or MGAs. An MGA can be thought of as a company that does everything an insurance company does that doesn’t require a license. An MGA has the authority to sell, distribute and underwrite insurance policies, collect premiums, handle claims, and otherwise manage a portfolio of insurance risks. The only thing it can’t do is keep the insurance risk on its own balance sheet – only a licensed insurer can do that. Therefore, an MGA will have a close contractual relationship with a licensed insurance company. The insurance company is the legal entity that issues the insurance policies and carries the risk on its balance sheet, even though an insured will primarily interact with the MGA and have little or no contact with the insurance company. This process is casually referred to as writing on an insurance company’s paper.

MGA Mechanics#

In terms of financial mechanics, the typical arrangement is for an MGA to have a contract with an insurance company where the MGA gets a fixed percentage of the premium (typically 20-35% of premium) called a ceding commission to cover its expenses, and the insurance company gets the rest of the premium to cover claims that arise under the policies written by the MGA.

Some insurers find offering paper to MGAs to be an easy way to increase the size of their book of business. However, there are risks associated with MGA business. In the arrangement outlined above, the MGA gets a fixed percentage of premium, regardless of how bad losses are. Thus, an MGA has a short-term incentive to sell as many insurance policies as it can without regard to their profitability, so that it can maximize its ceding commission. Some operators are notorious for launching an MGA, growing it over the span of few years, then walking away just as high loss ratios doom the program and the insurer takes a heavy loss – then starting the whole process over with a new MGA and new insurer.

Profit Commissions#

There are a couple of tools that insurers can use to reduce this risk. First, MGAs are typically kept on a fairly short leash by the insurers they work with. The insurer will typically specify the exact types of policies that the MGA can sell; who the MGA can and cannot sell to; maximum limits on policy sizes and coverages; aggregate limits on the size of the program, and so forth. The insurer may also work closely with the MGA and raise concerns about program performance before it reaches crisis levels. The other tool that insurers typically use is profit commissions. This is money paid to MGAs on the basis of program loss ratios. A typical profit commission structure might be that an MGA would get 24% of premiums as a ceding commission, plus a 6% profit commission window between loss ratios of 60% and 66%. This means that (for example) if the loss ratio on the program is greater than 66%, the MGA would get a 24% commission; if the loss ratio is 65%, the MGA would get a 25% commission; if the loss ratio is 62%, the MGA would get a 28% commission, and if the loss ratio is less than 60%, the MGA would get a 30% commission. Ceding commissions and profit commissions are typically negotiated so that the ceding commission alone is barely enough to cover the MGA’s overhead, and so that the profit commission window is close to the program’s expected loss ratio. Thus, MGAs are given a strong financial incentive to ensure that the program’s loss ratio performance is not significantly worse than expected.

Reinsurers and Fronting Carriers#

The Law of Large Numbers#

As we noted at the beginning of this section, insurance policies are fundamentally risk transfer mechanisms. The reason that risk transfer works is because of a statistical phenomenon known as the law of large numbers. If I were to bet a dollar on a fair coin flip at even money, I’d better have at least one dollar in my wallet to pay in case I lose. However, if I were to bet a dollar each on a thousand consecutive coin flips at even money, I’d almost certainly be OK even if I only had $100 in my wallet – the odds of losses exceeding $100 are less than 0.1%! The law of large numbers basically says that if you aggregate the results of a bunch of random events together, you can predict the average outcome with a fair amount of certainty; and that as the number of events you aggregate tends toward infinity, the difference between the average outcome and the outcome you observe tends toward zero.

The whole reason insurance companies work financially is because they are able to aggregate a lot of risks together and thereby gain more certainty about the average outcome of the pool of risks they are responsible for. An insurance company that only wrote one policy wouldn’t be taking advantage of the law of large numbers, and an insurance company that wrote a near-infinite number of policies would have very little risk to worry about. As an insurance company writes more policies, it has less aggregate risk to worry about. But what if an insurance company writes a substantial number of policies, but is still worried about the financial risks they face from their aggregate portfolio? It turns out there’s a solution for this: insurance companies can buy insurance for themselves!

Reinsurance#

When an insurance company buys insurance coverage itself, this is called reinsurance. Companies that sell reinsurance are called reinsurers, naturally enough. The dynamics of reinsurance are pretty similar to insurance, just at a larger scale. Individual insurers who want to transfer excess risk can obtain reinsurance policies from reinsurers; reinsurers are able to provide these policies because they diversify their risk by selling reinsurance to lots of insurance companies. Reinsurers tend to be bigger and better-capitalized than insurers; whereas there are thousands of insurers in the US alone, the reinsurance market is dominated by a relatively small number of global players.

Fronting Carriers#

In quota share reinsurance, a single reinsurer will typically prefer not to provide a 100% quota share for a program or insurer. However, there is nothing to stop an insurer from striking quota share deals from several reinsurers to obtain total coverage that amounts to a 80-100% quota share. If several reinsurers all issue quota share reinsurance for the same program at substantially the same terms, this is called participating on a reinsurance panel. This means that the following scenario is possible: an insurer makes a deal to provide paper for a particular MGA’s program. The insurer then immediately turns around and obtains quota share reinsurance for the entire program. (In fact, some insurers will require an MGA to line up its own reinsurance for the program as a precondition for providing paper!) In this case, the insurer has delegated the underwriting, sales, service, and claims functions to the MGA, and transferred virtually all of the insurance risk to a panel of reinsurers (except for the risk that the program loss ratio exceeds the quota share cap, which is typically extremely unlikely by design). At this point, the insurer has outsourced everything except for legally issuing the policies and dealing with state regulators! It turns out this scenario is not just possible, it is relatively common. Insurance companies with this business strategy are known in the industry as fronting carriers, or fronts.

The relationships between reinsurers, insurers (fronts), MGAs and issued policies is summarized in the following stocks and flows diagram, where the cars denote auto insurance policies.

Risk Originators#

All of this discussion about the structure of the insurance industry is useful to understand Ledger’s position in the marketplace. When we approach MGAs or fronting carriers, we are typically competing against traditional reinsurers. When we approach traditional insurers, we may be competing against alternative ways of obtaining additional capital. However, the legal status of the company that underwrites the insurance policies doesn’t change the mathematics of how we analyze the risk associated with a program. Therefore, we tend to use the generic term risk originator to refer to the company that manages a program, regardless of whether it’s an MGA or an insurer.