Policy and Premium Metrics

Contents

Policy and Premium Metrics#

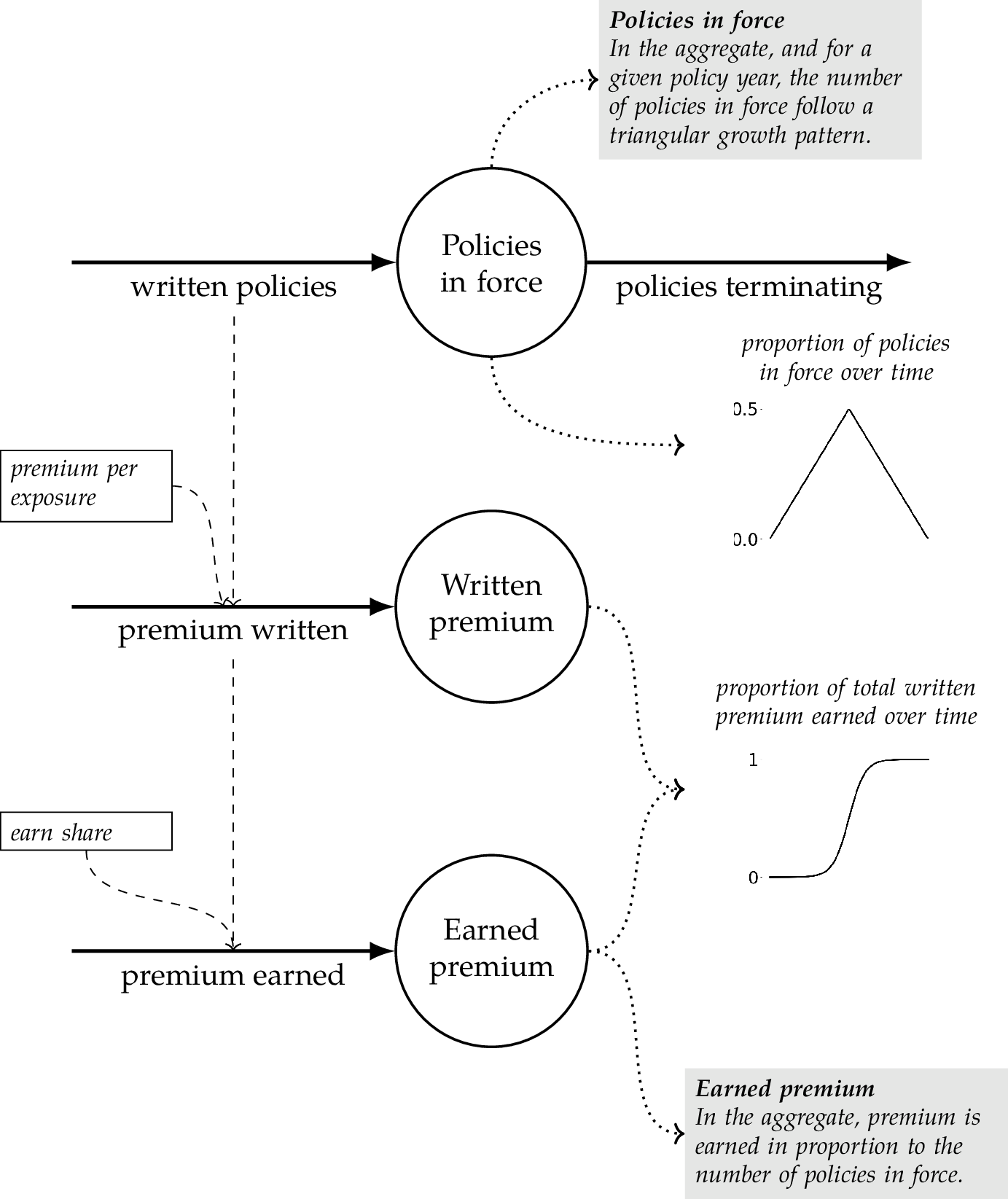

In this section, we briefly describe the main metrics of interest for policies, premium, and exposure, along with their basic definitions. The precise definitions of each of the metrics involve edge cases that we ignore at the moment for the sake of clear exposition. The diagram below sketches the overall relationship between the key metrics.

Policy Metrics#

There are two primary useful measures of policies.

Policies Written#

Policies written is a flow, and measures the number of policies written in a certain period. Policies written is computed as the count of distinct policy numbers with policy effective dates inside the experience period and record dates on or before the evaluation date. (This means that policies that have been written but have not gone in force yet are counted for the purposes of this metric.)

Policies in Force#

Policies in force is a stock, and measures the number of policies currently in effect, or “in force”. Policies in force is commonly abbreviated as PIF, which can be pronounced “pee eye eff” or “piff”. PIF is computed as the count of distinct policy numbers with a policy effective date on or before the experience date and a policy expiration date on or after the experience date, minus any cancelled policies. As with policies written, the PIF calculation only considers policy transactions with record dates on or before the evaluation date.

The value of policies as a unit of measure depends on the line of business. Typically, policies are a more useful measure on personal lines than commercial lines. Each policy on a personal lines product typically equates to a household, whereas each policy on a commercial lines product typically equates to a business. In personal auto insurance, you may live in a household with a spouse, three teenage children, and four cars; whereas I may live alone and own only one car. Each of our households probably has one auto policy. The size of our policies, as measured by premium or exposure, is significantly different, but they are still on the same order of magnitude.

In commercial auto insurance, your business may have a single van that delivers flowers around town, while my business may have a fleet of 500 tractor trailers that transports hazardous chemicals across state lines. Each of our businesses may have one commercial auto policy. In this case, my business’s policy could have a premium several thousand times higher than yours. Policy counts should start to feel a little silly at this point, because it’s a count of such an inhomogeneous group of items.

Measures of Premium#

There are several different ways to measure premium. The two most important measures for the purposes of risk analytics are written and earned premium. For any premium metric, we can compute it at the policy level or at an aggregate level. In general, the aggregate definitions of premium metrics are natural summations of the policy-level metrics.

Written Premium#

Written premium is a measure of the total contractual premium associated with a set of insurance policies. In our toy policy data schema above, written premium for any policy is the sum of written premium for all transactions associated with that policy.

Written premium in the aggregate is a flow, and measures the total written premium for a certain period. When we compute written premium, we assign transactions to experience periods based on the policy effective date, not the transaction effective date. We’ll explain why this definition makes sense a little later, when we discuss endorsements and cancellations.

Earned Premium#

When an insurance policy is written, all of the written premium initially shows up on the insurer’s balance sheet as a liability called unearned premium, even if the policy has been paid in full. The reason for this is that at the start of the policy term, the insurer has received the premium for the policy term, but has yet to provide any of the contractually obligated coverage to the insured. By recognizing this unearned premium as a liability, it helps insurers to more appropriately match revenues with expenses. Furthermore, most insurance contract give the insured the right to cancel coverage at any point in time and return a prorated refund for the remainder of the policy term. The entire written premium isn’t truly the insurer’s until the end of the policy term.

How is premium earned? The standard assumption is that premium is earned evenly over the duration of the policy term. If I purchase a 6-month auto insurance policy for $600, then after two months, the insurer has earned $200 of the premium. We call this amount earned premium, naturally enough.

Earned premium is a much more fluid quantity than written premium. Written premium is set when a policy is issued, and it remains the same unless the policy has more transactions. By contrast, earned premium changes daily while the policy is in force. Before the policy effective date, earned premium is always $0 by definition. After the policy expiration date, earned premium is always equal to written premium by definition. For dates between the policy effective date and policy expiration date, earned premium goes up daily. Another difference between earned premium and written premium is that depending on the transactions on a policy, written premium can go up or down over time. However, earned premium only ever stays the same or goes up; it never goes down (with a few rare exceptions we’ll discuss later).

Computing Earned Premium#

Typically, we care about earned premium at the aggregate (program) level, rather than the policy level. However, there are a few different ways to aggregate earned premium, and the distinction between them can be subtle. We’ll start by computing policy-level earned premium, which will form the foundation of our alternate premium aggregation methods.

Here is a brief worked example of earned premium calculations for a single policy. Say that an insurer writes a renter’s insurance policy with a written premium of $782. The policy effective date is 2022-06-13 and the policy expiration date is 2023-06-12. Assuming no further transactions on the policy, what is the earned premium as of 2022-10-24?

In this simple case, the expression for earned premium on a policy as of a given evaluation date is

Substituting in our given values, we have

So the earned premium as of 2022-10-24 is about $287.09.

Assumptions Behind Earned Premium#

The motivation behind earned premium is that we wish to match premium to risks over time in a proportional fashion, or approximate it as closely as possible. If we know that that 40% of expected loss costs on a policy are going to be from accidents in a certain period, then we should earn 40% of the policy’s premium in that period as well. In the formulas provided above, we assume that instantaneous risk is effectively constant over time, so earned premium is linearly interpolated between $0 and the full written premium over the course of the policy term. Strictly speaking, this assumption is wrong for every single insurance policy. Insurance companies have reams of data demonstrating that auto accidents are less common on weekends than weekdays. Workers’ compensation claims only occur when employees are at work, so we would expect higher workers’ compensation claim rates on weekdays for white collar workers, and higher workers’ compensation claim rates on weekends for hospitality and retail workers. Seasonal patterns in the underlying risk are even more problematic than patterns driven by the day of the week. If we examine a program that specializes in providing general liability insurance to ski resorts, we shouldn’t be surprised to see losses much higher in the winter months!

Common practice in the insurance industry is to politely ignore these inconsistencies between the idealized assumptions behind earned premium and the real world. If there is a noticeable seasonal pattern to claims, the seasonal pattern is handled later in the modeling process, rather than recalibrating earned premium assumptions.

Aggregating Earned Premium#

Now that we know how to compute earned premium for a given policy, how do we aggregate earned premium up for an experience period? As it turns out, there are two different ways to do this, each of which is useful in different contexts. The difference between the two aggregation methods is an attribute we call the risk basis. Risk basis can either be policy basis or accident basis.

Policy basis earned premium is easier to calculate, given policy level earned premium values. To compute policy basis earned premium, we sum the earned premium for all policies with policy effective dates within the experience period.

Accident basis earned premium is a bit more complex. In accident basis earned premium, we sum the portion of earned premium for each policy that was earned during the experience period. More formally, we can compute the accident basis earned premium for a given policy as:

Note that the definition is nearly the same, but for the addition of two new variables, \(\mathtt{period\_begin}\) and \(\mathtt{period\_end}\), which represent the first and last days of the experience period, respectively. The reason accident basis is called that may seem a little obscure now, but it will make more sense when we cover loss aggregation.

When accident basis or policy basis metrics are computed with annual experience periods, they are often called accident year or policy year metrics, and are abbreviated AY and PY, respectively. For example, unless explicitly mentioned otherwise, AY2019 is shorthand for the accident basis experience period 2019-01-01/2019-12-31. Similarly, accident quarter, policy quarter, accident month, and policy month are all shorthand for experience periods with natural calendar alignments: e.g., policy quarter 2021Q2 is the policy basis experience period 2019-04-01/2019-06-30.

Accident Basis vs Policy Basis#

There are a major difference between policy basis and accident basis earned premium in terms of their behavior. Barring a few rare circumstances we will cover later, accident basis earned premium is identical for any evaluation date after the end of the experience period. By contrast, policy basis earned premium will continue to change as a function of evaluation date until the last policy from the experience period reaches the end of its policy term – this delay could easily be a year or more after the end of the experience period.

Given the difference between accident basis and policy basis for earned premium, it is natural to ask whether there are accident basis and policy basis versions of written premium. The short answer is that the definition of written premium we just covered is effectively a policy basis definition, but that an accident basis definition of written premium doesn’t have an obviously interpretation or real-world application, so it is not used in practice.

Treaty Basis#

There is another risk basis in common usage: treaty basis. Risk originators typically obtain reinsurance coverage via reinsurance treaties. These treaties usually last about a year, but some treaties are longer or shorter than 12 months for the convenience of one or more of the parties to the contract. For example, a hypothetical program could have the following treaty dates:

Treaty 1:

2017-04-01/2018-03-31Treaty 2:

2018-04-01/2019-06-30Treaty 3:

2019-07-01/2020-08-31Treaty 4:

2020-09-01/2021-05-31Treaty 5:

2021-06-01/2022-05-31

This is a bit of an extreme example because only two of the five treaty years are exactly 12 months, but it illustrates the idea. All policies with a policy effective date within a treaty period are assigned to that treaty. Therefore, computing earned premium for a treaty is equivalent to computing policy basis earned premium for the treaty period. Treaties are important because reinsurers take risk on a treaty-by-treaty basis, and funds are transferred on the basis of treaty year performance. For these reasons, risk originators and reinsurers are intensely interested in treaty-by-treaty performance. Treaty basis is simply an easy way to reference treaty-level performance without explicitly specifying ever-shifting treaty dates. For example PY2018 refers to the policy experience period 2018-01-01/2018-12-31, but treaty year (TY) 2018 refers to the treaty period that started in 2018 – in this example, 2018-04-01/2019-03-31. It is much more convenient to specify TY2018, TY2019, etc., than to laboriously specify the exact treaty period for each successive treaty.

Collected Premium#

One other measure of premium is collected premium – the total amount of premium that the policyholder has paid to the insurer as of a given point in time. Collected premium is important for the risk originator’s daily operations, but it doesn’t play a meaningful role in insurance risk, reinsurance, or ILS. For that reason, we don’t consider it further.

Measures of Exposure#

We’ve covered written premium, policy basis earned premium, and accident basis earned premium. As it turns out, there are direct analogues of each of these concepts for exposure: written exposure, policy basis earned exposure, and accident basis earned exposure. They have exactly the same definitions as their premium equivalents, except for substituting exposure for premium and using different units (e.g., vehicle-years instead of dollars).